About Us

Infradebt is an Infrastructure Debt Fund (IDF) under NBFC format, formulated by the Government of India, with the objective of creating an alternative class of funding infrastructure by bringing in long term domestic/offshore institutional investors like insurance companies, provident/pension funds, etc.

As per the regulation, Infradebt invests in operational infrastructure projects that have a minimum of 1 year of successful operations.

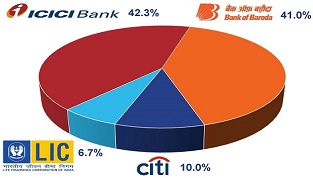

Infradebt has been set up by four leaders in the financial sector in India. ICICI Bank is the largest private sector bank in India. ICICI Bank is the largest shareholder with a 42.3% stake, followed by Bank

of Baroda 41%, Citicorp Finance India Limited 10% and Life Insurance Corporation of India 6.7%.

The shareholders will assist Infradebt in the following manner:

- ICICI Bank: Project finance and domestic fund raising

- Bank of Baroda: Project finance and domestic fund raising

- Citicorp Finance India Limited: Project finance and fund raising in international markets

- LIC: Investing in Tier-II capital and Senior Bonds issued by the company

Infradebt primarily raises funds from the domestic market by issuing Non-Convertible Debentures (NCDs) having a maturity period of more than five years. The regulated business model and strong credit framework

of Infradebt ensures 'Highest Safety' AAA returns for long-term investors. There are a diverse range of long-term investors, of which the prominent ones include:

- Life Insurance Companies

- General Insurance Companies

- Provident Funds

- Pension Funds

- Debt Mutual Funds

Vision: To be the most preferred infrastructure finance provider in India and contribute to nation building.

Mission:To provide best in class takeout funding and to supplement bank funding of infrastructure development in India.